It’s possible that a new small firm won’t have many expenses to keep track of. However, when your business expands, so will your expenses. You’ll need to keep track of your expenses using an expense report form.

An expense reporting will help ensure that you are ready for tax season. A variety of charges can reduce the total amount owed.

- Select a Template

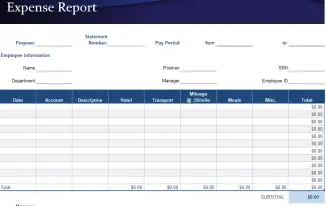

You can use a template or expense-tracking software to create an expense report. It can take a long time to create an expense report from the start. You’ll need to download a template to make an expense report in Excel, Word, PDF or other common programs. Add your company name, the date range you’re reporting on, and your name to the template. Upgrade to expense-tracking software to save time as your business (and amount of expenses) expands. Connect your business bank account so that expenses are automatically recorded. Alternatively, you can use the app to capture paper receipts as you receive them.

- Change the Columns

Standard columns in expenditure reports can be used to customize your expense report template if necessary. The columns are as follows:

- Purchase date: when the item was purchased

- Vendor: the store where the item was purchased

- Client: Who was the item purchased for?

- Project: What was the item purchased for?

- Account: a name for a client or a project.

- Author: the person who purchased the item

- Notes: make notes to explain the cost.

- Amount: the expense’s cost

Your columns should reflect typical business expenses. If you regularly take clients out for coffee or dinner, you’ll need a “travel and meals” column. According to The Balance, you’ll need a “car and truck expenses” column if you drive a vehicle for work purposes. Expense reports can be broken down by tax category, such as rent. Because the IRS permits businesses to deduct some expenses and requires them to break down the totals by category, this is the case.

- Include Itemized Expenses in your budget

Create a new line for each expense, being sure to include as much information as possible. You guarantee accurate tracking; make sure to specify the client and project the spending is for.

Enter your expenses in the order that they occurred, with the most recent item at the top. Add the total of each expense, including taxes.

- Add the totals together

On an expense report, each category has a subtotal, followed by a total of all expenses. If you choose, you can include this option in your expense report template so you can see how much you’re spending in each category. Then calculate the sum. If you’re reimbursing an employee, take into account any previous over or underpayments.

- If necessary, attach receipts

Employees who are submitting expense reports for reimbursement must include receipts to support their claims. If you’re going to print the expenditure report, tape the receipts to a laser printer sheet and print them, so you don’t lose the originals. Scanner the receipts and attach them as files if you’re submitting the expense report electronically. An employee can only be reimbursed after that.

- The Report can be printed or sent.

Your spending report is now complete. To begin, double-check your work, particularly the figures and total. Expense stalking software may transfer your Report to Excel, making it stress-free to print or share.